SUSTAINABILITY

LCA and ISO CERTIFICATIONInternational LCA standard – ISO14040/44 certified

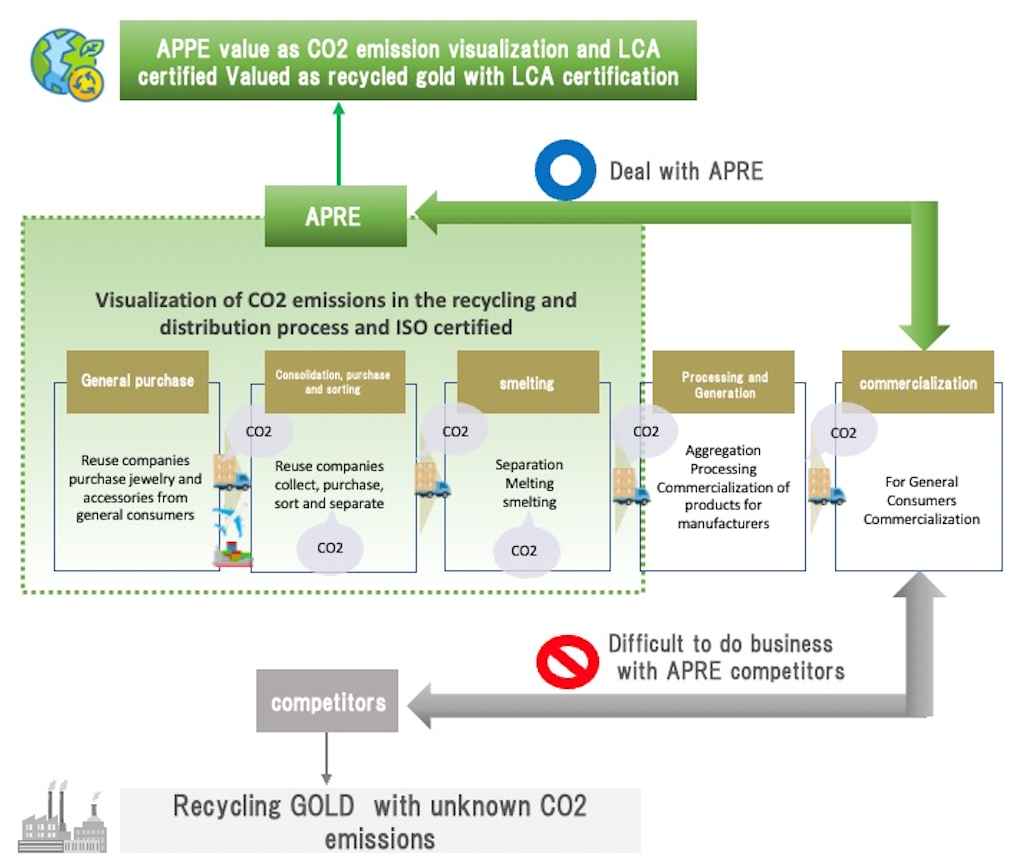

As a pioneering effort in the domestic precious metals industry, APRE conducted a Life Cycle Assessment (LCA) of the recycled gold (recycled gold derived from urban mines) we handle.

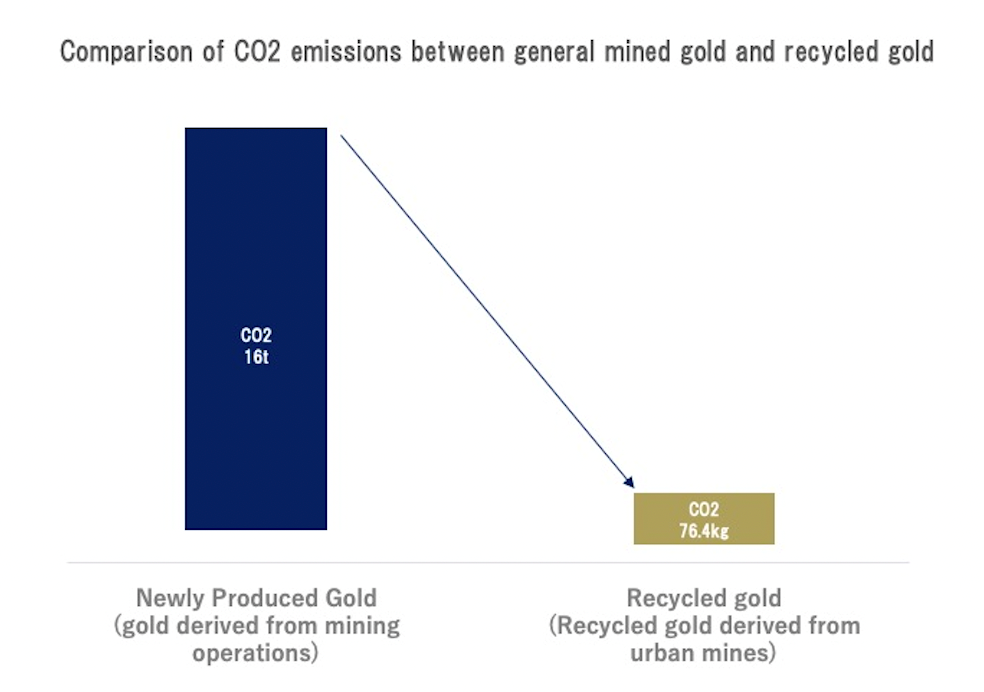

By verifying the environmental impact generated in the gold recycling process based on scientific processes, it was clarified that the impact is equivalent to approximately 76.4 kg of CO2 emissions per 1 kg of recycled gold produced.

As a pioneering effort in the domestic precious metals industry, APRE conducted a Life Cycle Assessment (LCA) of the recycled gold (recycled gold derived from urban mines) we handle.

By verifying the environmental impact generated in the gold recycling process based on scientific processes, it was clarified that the impact is equivalent to approximately 76.4 kg of CO2 emissions per 1 kg of recycled gold produced.

※based on our own research

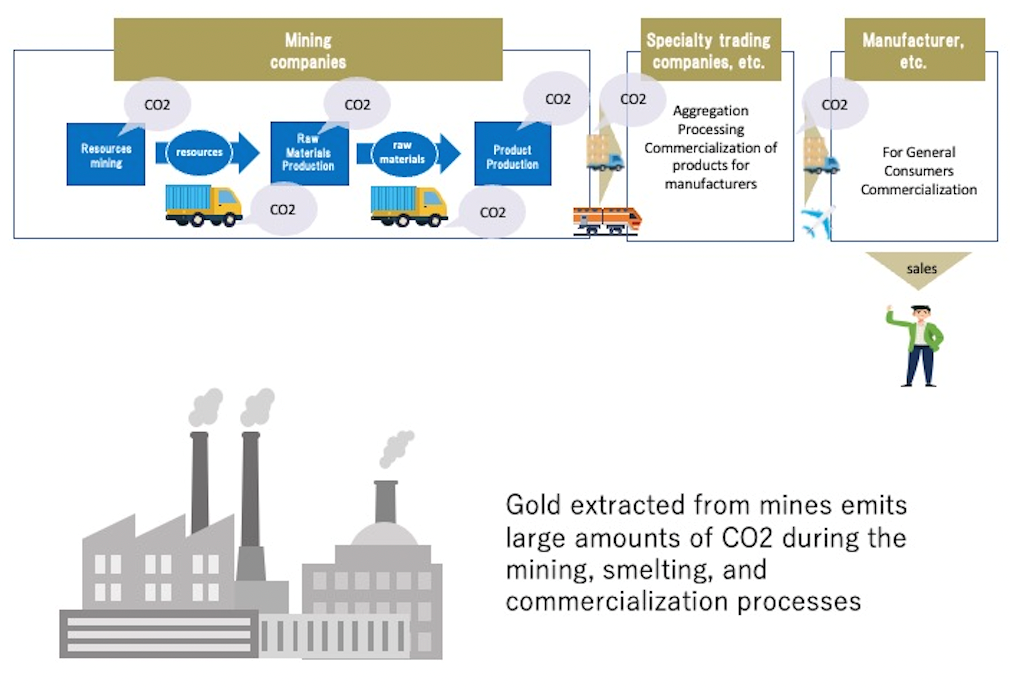

In the survey, a comparative evaluation was made with reference to a previous survey that found that the production of one kilogram of new gold (gold derived from mining) has an environmental impact equivalent to about 16.0 tons-CO2. As a result, it was proven that the environmental impact of the recycled gold we handle is approximately 1/200th of that of new gold, and that the use of recycled gold makes a significant contribution to addressing environmental issues.

※We conduct objective and reliable evaluations based on methods compliant with international LCA standards (ISO1404040/ISO14044).

As a company, we aim to contribute to the reduction of CO2 emissions through our precious metal recycling and sales business. As part of this effort, we have conducted a study of CO2 emissions generated in the recycling process and obtained ISO 14040/44 certification, an international LCA standard, for the report.

This certification will enable our suppliers to recognize the specific CO2 emission reductions of the recycled gold they handle.

As companies around the world work toward reduction targets for 2030 and 2050, we believe that this survey and certification will help our customers feel more secure in handling our recycled gold.

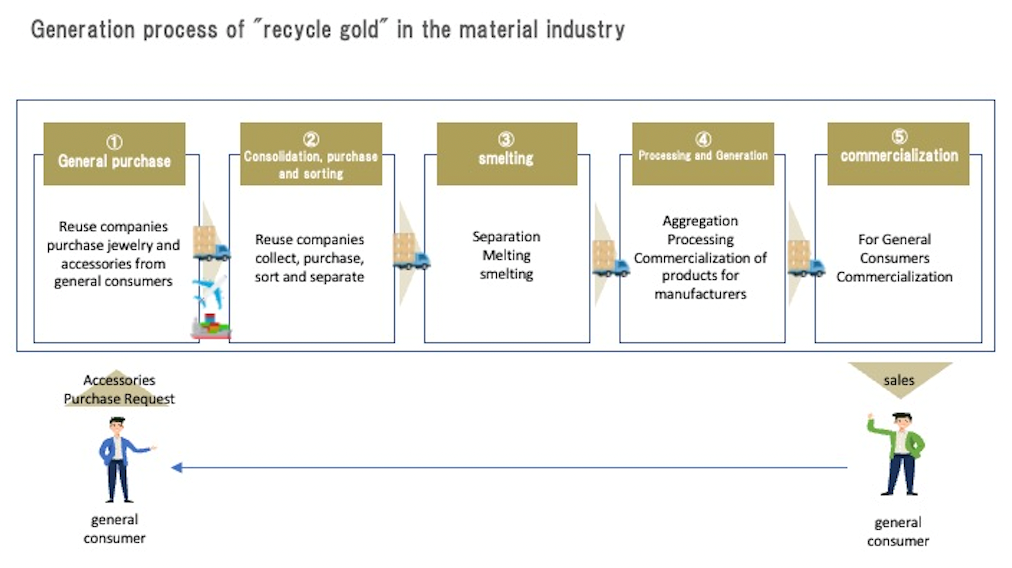

(1) Reuse businesses nationwide purchase gold products, accessories, and. other precious metal products owned by general consumers.

(1) Reuse businesses nationwide purchase gold products, accessories, and. other precious metal products owned by general consumers.(2) After the products are collected from the reuse businesses, they are sorted. and separated and sent to a refining company.

(3) The products are dissolved to produce high-purity bullion.

(4) Ingot is sold to companies that manufacture precious metal products. through trading companies.

(5)The companies use the bullion as raw materials to manufacture precious. metal products and sell them to the general public.

About LCALCA(Life Cycle Assessment)

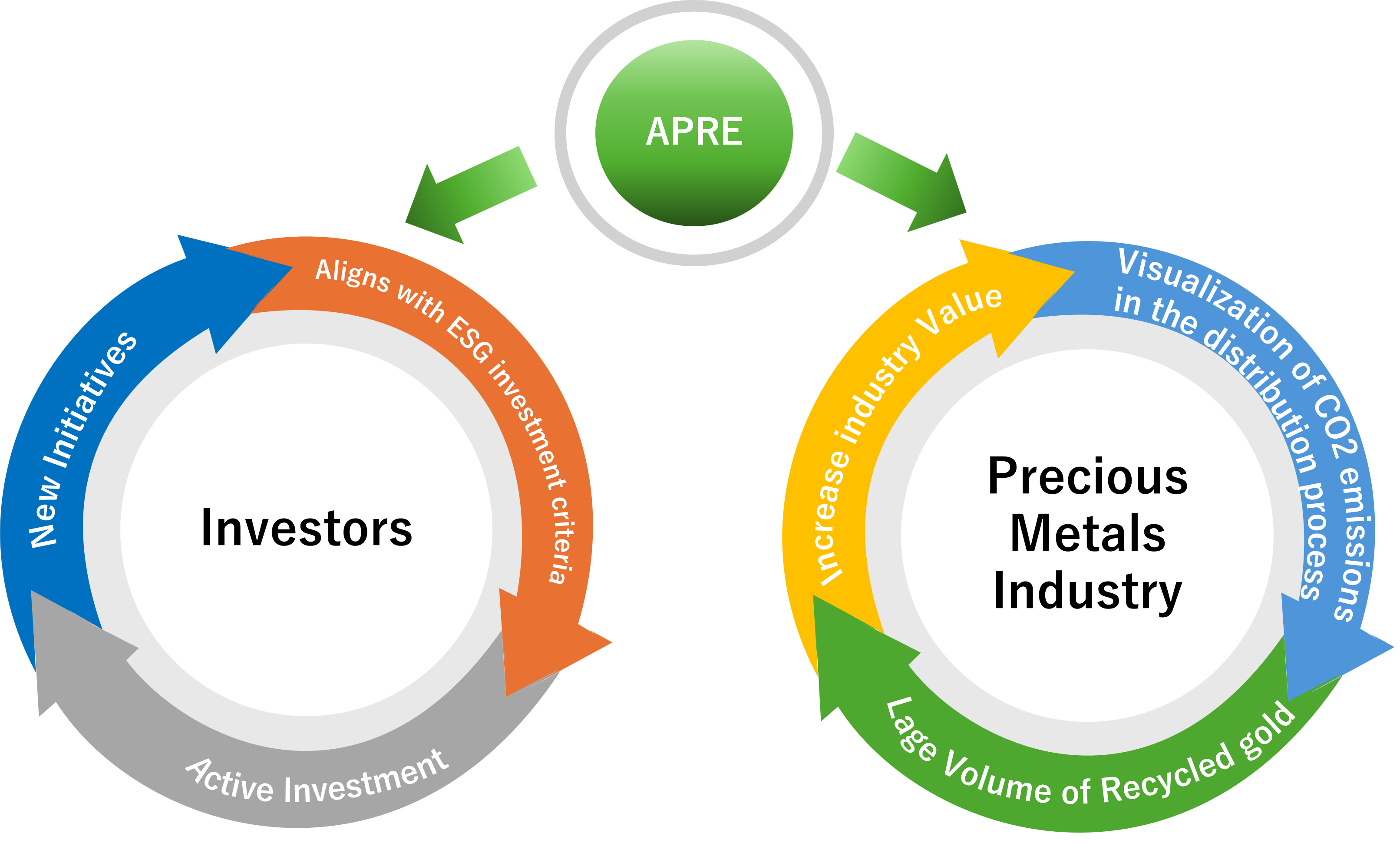

In the future, it is expected that it will become increasingly important for companies to understand the specific environmental impacts of their companies and products in order to set concrete CO2 reduction targets for 2030 and 2050 in the course of their economic activities. We believe that the data obtained from our LCA studies will contribute to the enhancement of the business value of companies in the precious metals industry.

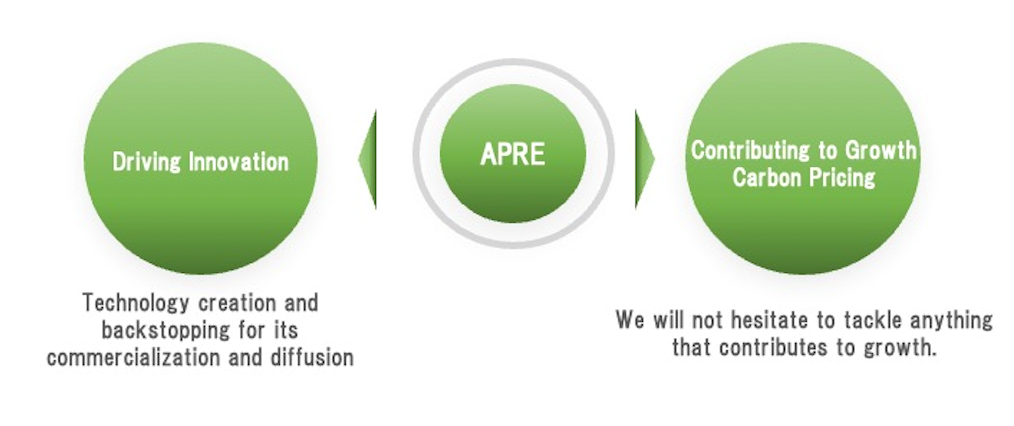

We aim to create new value beyond CO2 visualization and ISO certification to enhance the value of our stakeholders. In addition, we will conduct activities in line with each of the items listed in the “Long-Term Strategy as a Growth Strategy Based on the Paris Agreement” announced by the Japanese government in 2021. We will contribute to the realization of carbon neutrality around the world by proactively implementing industry-leading initiatives, such as the use of carbon credits.

VISIONAPRE Business Activities and Environmental Issues

The “Long-Term Strategy as a Growth Strategy Based on the Paris Agreement” was developed based on the provisions of the Paris Agreement, and presents the basic approach and vision toward carbon neutrality by 2050.

<Basic Concept>

Global warming countermeasures are defined not as a constraint on economic growth, but as the key to a major transformation of the economy and society, stimulating investment, increasing productivity, and creating a major shift in industrial structure and strong growth. Within this definition, “cross-sectoral measures that transcend fields of business and are focused on” are clearly stated. Among them, the following items are relevant to our business activities.

(omitted)

As AI, IOT, blockchain technology, and other technologies advance, it is necessary for the public and private sectors to work together on cross-sector innovation.